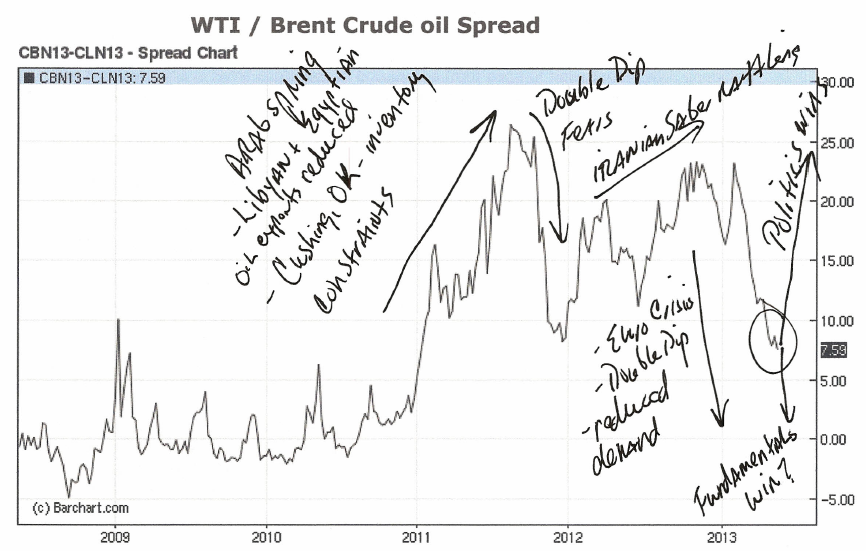

COMPLACENCY OR JUST FUNDAMENTALS??

- Greatest risk level since early 2011 to sudden spread widening due to real or perceived supply disruption/ headline risk.

- Supply/demand fundamentals continue to pressure the WTI/Brent spread lower towards the long term average of +/- $5.

- As North American production continues to increase and replace imported oil increasingly the WTI/Brent spread will reflect and be contained to Brent oil price swings.

- OPEC continues to reduce production, $90 per barrel price acceptable to OPEC and OPEC expects increase in demand from improving economies in the second half of the year. Continue reading