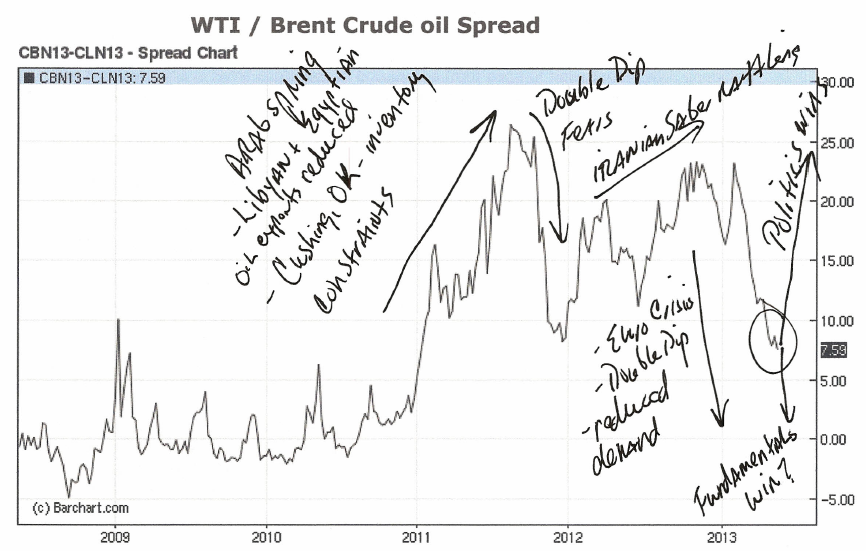

COMPLACENCY OR JUST FUNDAMENTALS??

- Greatest risk level since early 2011 to sudden spread widening due to real or perceived supply disruption/ headline risk.

- Supply/demand fundamentals continue to pressure the WTI/Brent spread lower towards the long term average of +/- $5.

- As North American production continues to increase and replace imported oil increasingly the WTI/Brent spread will reflect and be contained to Brent oil price swings.

- OPEC continues to reduce production, $90 per barrel price acceptable to OPEC and OPEC expects increase in demand from improving economies in the second half of the year.

As the above chart reflects the WTI/Brent crude oil spread at a critical level. Is the spread about to return to the historic range +/- $5? Or is the market reflecting an uncomfortable level of complacency concerning the likely hood of supply disruptions from political unrest in the Middle East, particularly, regarding Iran’s continued work on nuclear material enrichment and the West’s concerns that such activities masquerade a nuclear weapons development program?

The political crisis in Syria continues to occupy the front page of newspapers with unending stories of atrocities inflicted upon the civilian population. Indeed, the attention focused on Syria takes attention away from Iran, as the regime thumbs its nose at the United Nations, concerned Arab neighbors, Israel, as well as, the rest of the Western World with continued nuclear material enrichment efforts. Taking Iran off the front page removes a constant reminder to the markets of the seriousness of Israel and the West’s commitment to prevent Iranian nuclear weapons development at all costs. Iran has stated that any overt move against its facilities would lead to the closure of the Straits of Hormuz thus bottling up 20% of OPEC’s daily exports.

Meanwhile the market reacts to favorable supply-demand fundamentals which continue to pressure the spread lower. The markets increasingly discount significant increase in North American production, increased pipeline development that relieves pressure on Cushing, OK inventory constraints and providing greater supply to U.S. refineries. Less reliance on imported oil relieves global pressures on OPEC oil even as OPEC reduces production. All of which is reflected in easing gasoline prices as we enter the peak summer driving season.

At current levels the WTI/Brent spread is especially vulnerable to head line risk. While fundamentals support continued spread narrowing, the risk is a sudden and potentially violent spread widening from Iranian saber rattling or an actual preemptive move against Iranian nuclear facilities.